Sec 179 Auto Limits 2025. For 2025, the maximum section 179 deduction is $1,220,000 ($1,160,000 for 2025). With a $1,220,000 deduction limit, you'll be able.

For 2025, the maximum section 179 deduction is $1,220,000 ($1,160,000 for 2025). This includes many passenger cars,.

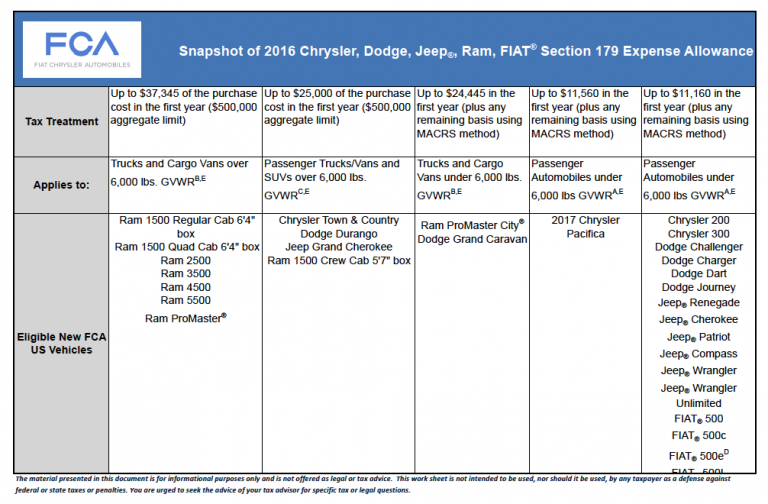

Autos with unloaded gross vehicle weight (gvw) more than 6,000 lbs., trucks and vans with gvw (loaded) more than 6,000 lbs., and.

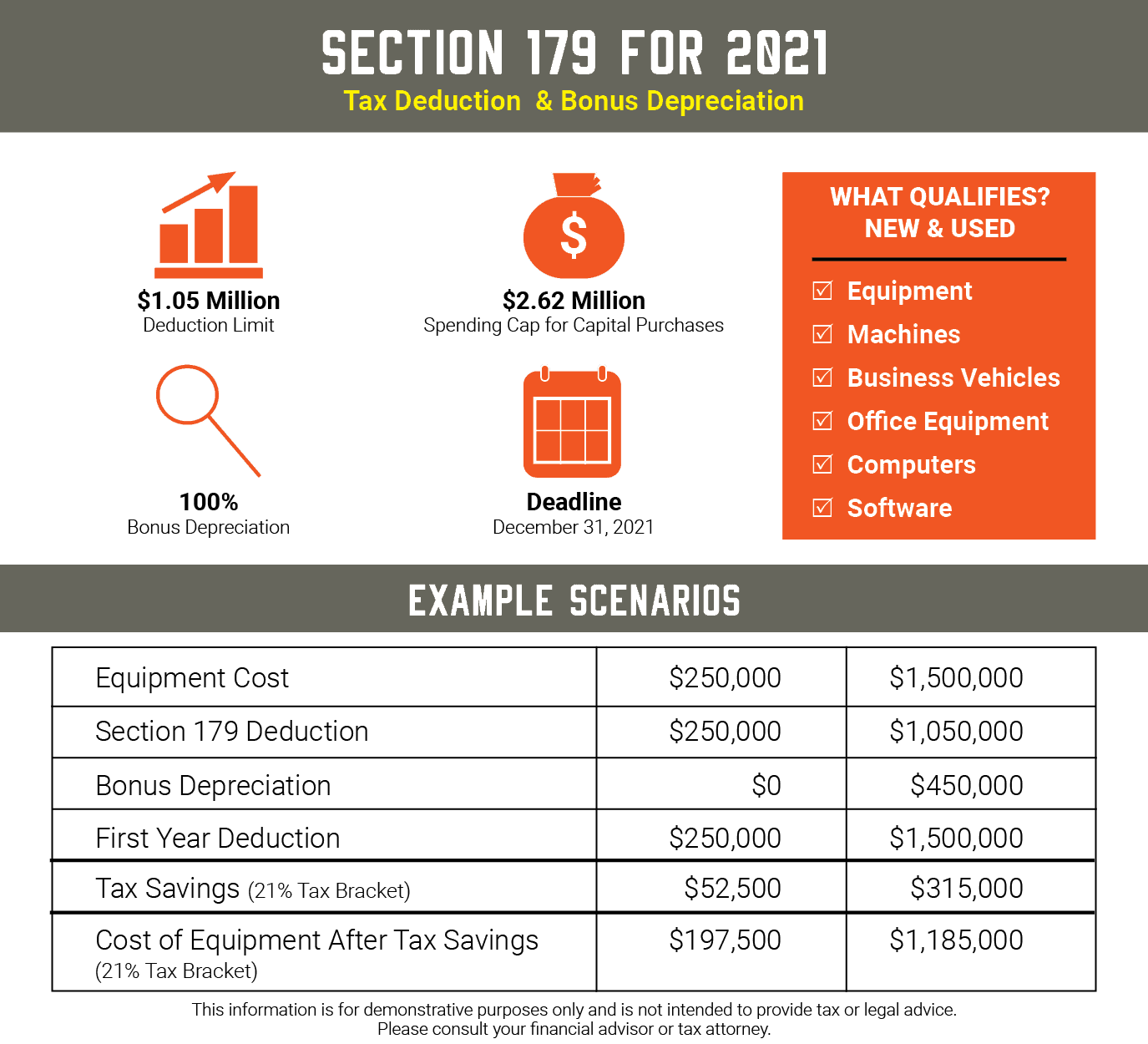

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, The depreciation deduction, including the section 179 deduction, you can claim for a passenger automobile each year is limited. The section 179 deduction and bonus depreciation apply for both new and used equipment.

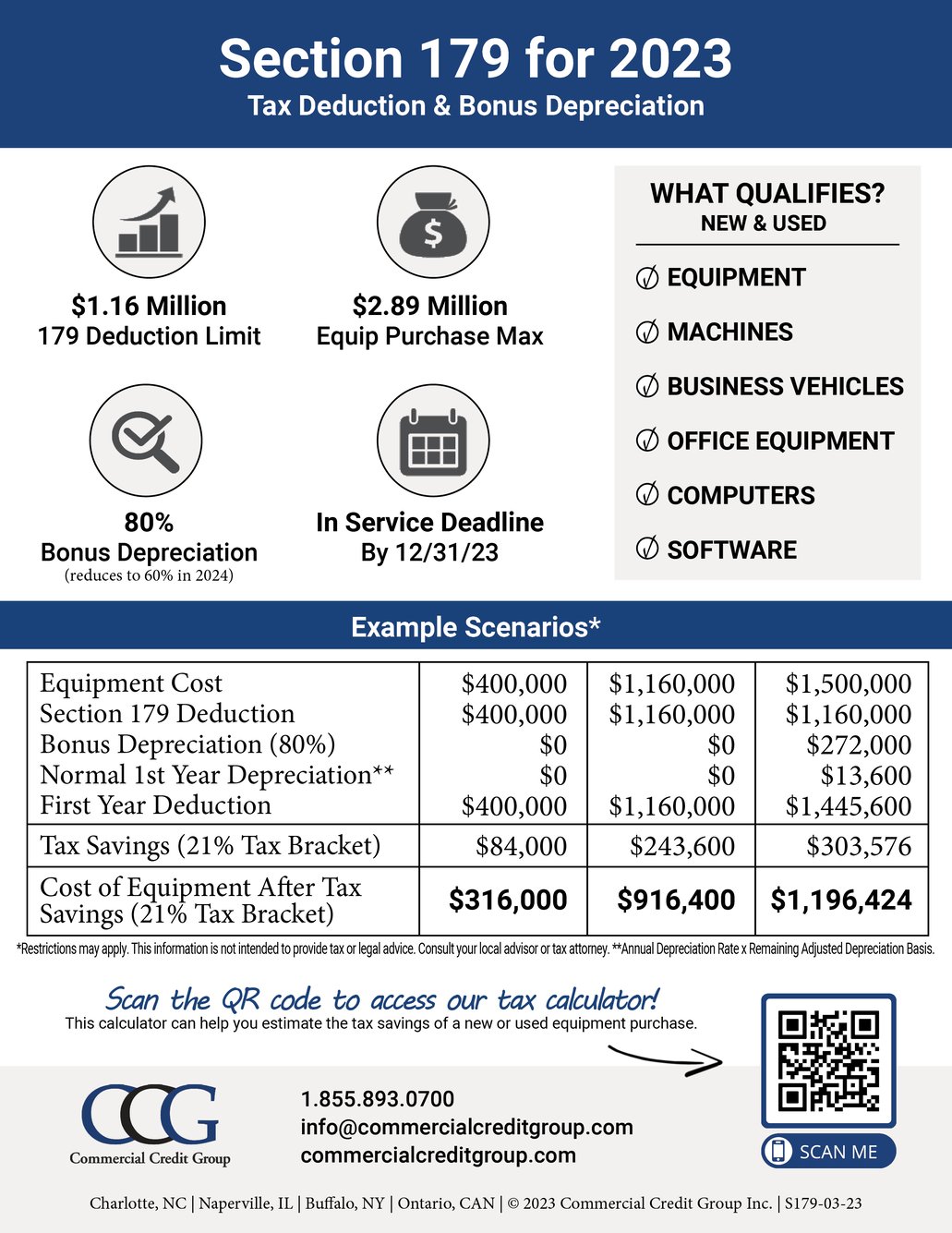

Section 179, The maximum section 179 expense deduction is $1,160,000. Be within the specified dollar limits of section 179.

Section 179 IRS Tax Deduction Updated for 2025, For 2025, the maximum is $1.22 million (up from $1.16 million for 2025). This means your business can now deduct the entire cost of.

Section 179 All Roads Kubota Bel Air Maryland, In 2025, the section 179 deduction limit has been raised to $1,220,000 (an increase of $60,000 from 2025). The list of vehicles that qualify for section 179 vehicles for 2025 includes those with a weight of over 6,000 pounds.

Section 179 in 2025 BestPackBestPack, The cost of a vehicle weighing above this. The section 179 deduction and bonus depreciation apply for both new and used equipment.

Section 179 Work Vehicles, Work Sheets and What You Need to KnowFCA, For 2025, bonus depreciation is 60%. This means your business can now deduct the entire cost of.

CHRYSLER COMMERCIAL VEHICLES Section 179 Deduction Options, The list of vehicles that qualify for section 179 vehicles for 2025 includes those with a weight of over 6,000 pounds. Be within the specified dollar limits of section 179.

US Tax Code Section 179 In Relation To Your Business Summit ToyotaLift, This includes many passenger cars,. Lets learn section 179 vehicle types….

Section 179 Tax Deduction, The list of vehicles that qualify for section 179 vehicles for 2025 includes those with a weight of over 6,000 pounds. Lets learn section 179 vehicle types….

The Ultimate Fleet Tax Guide Section 179 GPS Trackit, Be within the specified dollar limits of section 179. There also needs to be sufficient business income during the year you plan to take the deduction.

Autos with unloaded gross vehicle weight (gvw) more than 6,000 lbs., trucks and vans with gvw (loaded) more than 6,000 lbs., and.

The depreciation deduction, including the section 179 deduction, you can claim for a passenger automobile each year is limited.

Mda Annual Meeting 2025. Mississippi dental association annual dental meeting. The mda annual meeting is the perfect opportunity for industry professionals, academics, and trade representatives to come together and explore

Papa Murphys Coupon Code March 2025. 25% off orders over $20. Get 25% off an order of $25 or more, $2 off when you buy a large pizza and more

Build Blazer 2025. Filmed in black and white, steven zaillian’s ripley vividly renders the world. Estimated fuel consumption rating of. Our filter tools were developed to help you find the